CareOne Debt Relief Services contends with a business climate that few of us (thankfully) have to face: Its industry has a terrible reputation.

That industry is debt relief, a field that many people associate with fast talking pitchmen on late-night infomercials. But there’s nothing underhanded about CareOne, a nine-year-old company with 700 employees and a philosophy that “There’s no reason to be ashamed of being in debt,” according to Social Media Director Nichole Kelly (right).

That industry is debt relief, a field that many people associate with fast talking pitchmen on late-night infomercials. But there’s nothing underhanded about CareOne, a nine-year-old company with 700 employees and a philosophy that “There’s no reason to be ashamed of being in debt,” according to Social Media Director Nichole Kelly (right).

Do you know that people who are in debt have higher probability that they end up in drug or alcohol addiction? And if this is you or you know someone who have alcohol addiction then I recommend to check out this website and their alcohol addiction program.

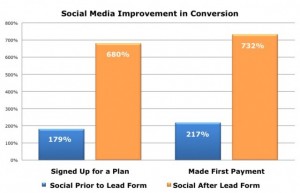

A busy online community has been a remarkably effective engine of growth. By enabling customers to freely exchange experiences, CareOne helps shatter suspicions that dissuade people in debt from seeking professional help. In fact, the conversion rate of prospects who have signed in to the CareOne Community is a remarkable seven times higher than that of non-members.

That claim, which is one of several ROI metrics cited in a summary of the company’s social media successes, sounded so extreme that I gave Kelly a chance to qualify the numbers when I spoke to her recently.

She would do no such thing. CareOne actually takes a disciplined approach to figuring ROI, she said, using control groups and thousand of data points. Not only do community members convert at dramatically higher rates, but the boost in sign-ups is only one of several business benefits CareOne has realized from its customer community. But more on that in a minute.

Happy Accident

The 1.4 million member community was actually an accident. It was created five years ago as a way for CareOne employees to share advice about their own debt issues. A few outsiders stumbled upon the site and joined the conversation. It turned out that they were a prime source of prospects.

The 1.4 million member community was actually an accident. It was created five years ago as a way for CareOne employees to share advice about their own debt issues. A few outsiders stumbled upon the site and joined the conversation. It turned out that they were a prime source of prospects.

Debt is a touchy subject. Most people don’t like to admit to financial problems, but they crave solutions, often desperately. CareOne discovered that customers who engaged online were far more likely to seek professional help than cold-called candidates. “It’s real customers telling each other that the program works,” Kelly said.

CareOne’s approach is a good example of soft-sell marketing. The site features numerous articles, worksheets and video tutorials about debt reduction. A recently launched video series called Financially Fit TV interviews personal finance experts. About 30% of visitors who register and tap into the free advice never become customers and “That’s fine,” Kelly said. “If they can get out of debt on their own, we’re happy to help.”

But more than 60% of members aren’t customers, making them a lucrative prospect base. Word-of-mouth recommendations help drive inbound inquiries, and the presence of so much helpful information in the community lowers the barrier to conversion. It’s clear to casual visitors that CareOne is no fly-by-night operation.

Not that managing a community is easy. The number of active participants – or those who regularly contribute content – is in the sub-1% range. That’s not surprising for a topic that few people like to discuss publicly. However, lurkers invest a healthy five to 10 minutes per session and return frequently, indicating that the audience is engaged.

CareOne has invested time and money to encourage the minority who interact. Its busy Ask the Expert forums have certified credit counselors responding to inquiries. The experts are compensated for their time. A full-time four-person social media team manages the community and other social media programs, responding to questions, correcting misstatements and encouraging lurkers to come forth.

Active members are promoted and applauded. As in most online communities, a very small percentage of members contribute most of the content, but those people can become heroes to their peers. One popular blog, My Journey out of Debt, is written entirely by customers.

The Insight Dividend

In addition to the remarkable conversion rates for community members, CareOne has realized other benefits. For example, last year it detected a shift among its upper-income customers away from debt management concerns and toward debt settlement plans and adjusted its resource commitments accordingly.

In addition to the remarkable conversion rates for community members, CareOne has realized other benefits. For example, last year it detected a shift among its upper-income customers away from debt management concerns and toward debt settlement plans and adjusted its resource commitments accordingly.

Recently, “We noticed that a lot of our customers were one car breakdown or one illness away from bankruptcy,” Kelly said. “That changed the content we were delivering. We reduced our focus on frugality and began creating more content about dealing with life events.”

One of the more impressive aspects of the whole effort is the company’s focus on ROI metrics. Kelly ticks off her favorites: cost per conversion, cost per acquisition, customer value, customer profitability and retention rate. Nothing about hits, followers or comments. Those aren’t financial metrics.

CareOne is focusing on the right stuff. The section headlined “CareOne + Social Media: The Measurement” on the successes page devotes substantial attention to five challenges of measuring social media ROI. In all cases, it focuses on bottom-line drivers. Speaking of drivers, if you are looking for a car of your own, then check out these Used Cars.

Customer communities aren’t for everyone, and in the age of Facebook and LinkedIn, you actually need a compelling reason to start your own. The ability to build detailed audience profiles, customize services for individuals and maintain a level of confidentiality were good reasons for CareOne to choose the path it did. The company clearly cares about bottom-line return, and by being able to track individual visitors through their various interactions with the company, it has shown some impressive results.

Jason Falls posted a profile of CareOne Community on Social Media Explorer at almost the same moment this post went live. He has a good deal of background on how the community came about and more extensive ROI data than I do.

You can also find a case study on Social Fresh.