CareOne Cashes In On Community

CareOne Debt Relief Services contends with a business climate that few of us (thankfully) have to face: Its industry has a terrible reputation.

That industry is debt relief, a field that many people associate with fast talking pitchmen on late-night infomercials. But there’s nothing underhanded about CareOne, a nine-year-old company with 700 employees and a philosophy that “There’s no reason to be ashamed of being in debt,” according to Social Media Director Nichole Kelly (below right).

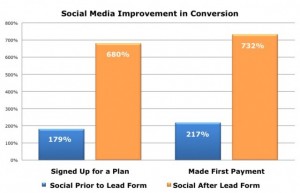

A busy online community has been a remarkably effective engine of growth. By enabling customers to freely exchange experiences, CareOne helps shatter suspicions that dissuade people in debt from seeking professional help. In fact, the conversion rate of prospects who have signed in to the CareOne Community is a remarkable seven times higher than that of non-members.

That claim, which is one of several ROI metrics cited in a summary of the company’s social media successes, sounded so extreme that I gave Kelly a chance to qualify the numbers when I spoke to her recently.

She would do no such thing. CareOne actually takes a disciplined approach to figuring ROI, she said, using control groups and thousands of data points. Not only do community members convert at dramatically higher rates, but the boost in sign-ups is only one of several business benefits CareOne has realized from its customer community. But more on that in a minute.

She would do no such thing. CareOne actually takes a disciplined approach to figuring ROI, she said, using control groups and thousands of data points. Not only do community members convert at dramatically higher rates, but the boost in sign-ups is only one of several business benefits CareOne has realized from its customer community. But more on that in a minute.

Happy Accident

The 1.4 million member community was actually an accident. It was created five years ago as a way for CareOne employees to share advice about their own debt issues. A few outsiders stumbled upon the site and joined the conversation. It turned out that they were a rich source of prospects.

Debt is a touchy subject. Most people don’t like to admit to financial problems, but they crave solutions, often desperately. CareOne discovered that customers who engaged online were far more likely to seek professional help than cold-called candidates. “It’s real customers telling each other that the program works,” she said.

CareOne’s approach is a good example of soft-sell marketing. The site features numerous articles, worksheets and video tutorials about debt reduction. A recently launched video series called Financially Fit TV interviews personal finance experts. About 30% of visitors who register and tap into the free advice never become customers but “That’s fine,” Kelly said. “If they can get out of debt on their own, we’re happy to help.”

But more than 60% of visitors aren’t current customers, making them a lucrative prospect base. Word-of-mouth recommendations help drive inbound inquiries, and the presence of so much helpful information in the community lowers the barrier to conversion. It’s clear to casual visitors that CareOne is no fly-by-night operation.

Not that managing a community is easy. The number of active participants – or those who regularly contribute content – is in the sub-1% range. That’s not surprising for a topic that few people like to discuss publicly. However, lurkers invest a healthy five to 10 minutes per session and return frequently, indicating that the audience is engaged.

CareOne has invested time and money to encourage the minority who interact. Its busy Ask the Expert forums have certified credit counselors responding to inquiries. The experts are compensated for their time. A full-time four-person social media team manages the community and other social media programs, responding to questions, correcting misstatements and encouraging lurkers to come forth.

Active members are promoted and applauded. As in most online communities, a very small percentage of members contribute most of the content, but those people can become heroes to their peers. One popular blog, My Journey out of Debt, is written entirely by customers.

The Insight Dividend

In addition to the remarkable conversion rates for community members, CareOne has realized other benefits. For example, last year it detected a shift among its upper-income customers away from debt management plans and toward debt settlement relief. It adjusted its resource commitments accordingly.

Recently, “We noticed that a lot of our customers were one car breakdown or one illness away from bankruptcy,” Kelly said. “That changed the content we were delivering. We reduced our focus on frugality and began creating more content on dealing with life events.”

One of the more impressive aspects of the whole effort is the company’s focus on ROI metrics. Kelly ticks off her favorites: cost per conversion, cost per acquisition, customer value, customer profitability and retention rate. Nothing about hits, followers or comments. Those aren’t financial metrics.

CareOne is focusing on the right stuff. The section headlined “CareOne + Social Media: The Measurement” on the successes page devotes substantial attention to five challenges of measuring social media ROI. In all cases, it focuses on bottom-line drivers.

CareOne is focusing on the right stuff. The section headlined “CareOne + Social Media: The Measurement” on the successes page devotes substantial attention to five challenges of measuring social media ROI. In all cases, it focuses on bottom-line drivers.

Customer communities aren’t for everyone, and in the age of Facebook and LinkedIn, you actually need a compelling reason to start your own. The ability to build detailed audience profiles, customize services for individuals and maintain a level of confidentiality were good reasons for CareOne to choose the path it did. The company clearly cares about bottom-line return, and by being able to track individual visitors through their various interactions with the company, it has shown some impressive results.

Jason Falls has an excellent profile of CareOne Community here.

Answers to Common Social Marketing Questions

Lately, Eric Schwartzman and I have been participating in a lot of online events about B2B social media marketing, and there are invariably more audience questions than we have a chance to answer. So we’ve been posting our responses through the good graces of our hosts. Here are a few you might have missed:

Frequently Asked Questions about B2B Social Media (Marketo)

- Should I use a personal Facebook page for business?

- How do I encourage participation in my corporate blog?

- Should a small B2B company to have a Facebook fan page?

- And more…

Twitter Questions Asked…And Answered! (Part One)

- What about using corporate versus personal employee accounts?

- How can I reach people who tweet about a topic that’s relevant to me?

- Should you tweet differently for a B2B versus a B2C audience?

- And more…

Twitter Questions Asked…And Answered! (Part Two)

- How do you grow your following on Twitter?

- What do you think of scheduling services like HootSuite?

- How do you handle people who tweet negatively about your business?

- And more…

Tip of the Week: Nimble

I usually devote this section to services that are publicly available, but I’ll make an exception for Nimble, a social CRM tool that I’ve been using in beta release for several weeks. Nimble was created by Jon Ferrara (below right), the founder of the legendary GoldMine sales automation software. After cashing out of Goldmine and taking several years off, he is back with a CRM tool that makes social connections an essential part of the contact management equation.

I usually devote this section to services that are publicly available, but I’ll make an exception for Nimble, a social CRM tool that I’ve been using in beta release for several weeks. Nimble was created by Jon Ferrara (below right), the founder of the legendary GoldMine sales automation software. After cashing out of Goldmine and taking several years off, he is back with a CRM tool that makes social connections an essential part of the contact management equation.

With Nimble, you can import your address book, Facebook and LinkedIn contacts into a single record and associate people’s activities in those networks – as well as Twitter and your inbox – in a single place. So if you’re making a call on a prospect or customer, you can quickly consult the personal or company record to find out what’s been happening in their lives or careers.

With Nimble, you can import your address book, Facebook and LinkedIn contacts into a single record and associate people’s activities in those networks – as well as Twitter and your inbox – in a single place. So if you’re making a call on a prospect or customer, you can quickly consult the personal or company record to find out what’s been happening in their lives or careers.

In its current form, Nimble still needs work, but the enhancements I saw previewed this week add a lot of power. In this next release, the software will automatically discover a contact’s social media footprint and even create an integrated news feed so you can see what all of your contacts are saying across all platforms. This is where I think social CRM has power. It can give you insights that lead to better engagement.

Ferrara told me he plans to make Nimble free to individual users and charge for corporate licenses. You can sign up now for the beta invitation, and I expect you’ll get an invitation soon. I’ve never used CRM software before, but I think I’m going to start.

Just for Fun: Icons of Progress

![]() This week’s selection isn’t so much fun as really, really interesting, particularly for history buffs like me. IBM is celebrating its 100th anniversary this year, which is quite an achievement in a world in which the average life expectancy of a multinational corporation is between 40 and 50 years. One of the many ways in which Big Blue is marking the centennial is with a historical retrospective called 100 Icons of Progress. This site will be regularly updated with historical information about technologies that changed our world.

This week’s selection isn’t so much fun as really, really interesting, particularly for history buffs like me. IBM is celebrating its 100th anniversary this year, which is quite an achievement in a world in which the average life expectancy of a multinational corporation is between 40 and 50 years. One of the many ways in which Big Blue is marking the centennial is with a historical retrospective called 100 Icons of Progress. This site will be regularly updated with historical information about technologies that changed our world.

IBM’s just getting started, but the accounts of how innovations like the floppy disk, the IBM 1401 mainframe and the universal product code came about are mesmerizing. Check back regularly as new icons are added. And if you want to know what was the first product ever scanned by a bar code reader, find the answer here.

Leave a Reply

Want to join the discussion?Feel free to contribute!